Banking Industry is one of the most auspicious industries of our country. Generally by the word ‘Bank’ we can easily understand that it usually deals with money. There are different types of banks such as; commercial Bank, Agricultural Bank, Industrial Bank, Savings Bank & Exchange Bank. But when we use the term ‘Bank’ without any prefix, or qualification, it refers to the ‘Commercial Bank’. Commercial banks are the primary contributors to the economy of a country. It helps to flow funds from surplus unit to deficit unit and through this it facilitated the efficient allocation of the resources as well as accelerated economic growth. This sector is moving towards new dimension as it is changing fast due to competition, deregulation and financial reforms. BRAC Bank Limited is a scheduled commercial bank in Bangladesh. It established in Bangladesh under the Banking Companies Act, 1991 and incorporated as private limited company on May 20, 1999 under the Companies Act, 1994. Its operation started on July 4, 2001 with a vision to be the market leader through providing all sorts of support to people in term of promoting corporate and small entrepreneurs and individuals all over the Bangladesh.

BRAC Bank, for the first time among local commercial banks, starts providing loan facilities to small and medium trading, manufacturing and service oriented enterprises all over the country. In this competitive banking industry, BRAC Bank is trying to differentiate them through their service and variety of products. BRAC Bank tries to provide service to its customers and gain the sustainable relationship with them.

OBJECTIVE OF THE REPORT

The objective of the report can be viewed in two forms:

- General Objective

- Specific Objective

General Objective:

The general objective of my internship is to get well acquainted with the retail banking service of BRAC Bank Ltd.

Specific Objective:

More specifically, this study entails the following aspects:

- To get some knowledge about the other function related to retail banking division and also to know about the market position and background of BRAC Bank Ltd.

- To know about the customer’s acceptance level regarding the recent change of BRAC Bank retail banking division.

- To know about whether the customer is satisfied with service of BRAC Bank Ltd. Or not.

- To know about whether customer is getting more benefits from branches as the retail banking has shifted their focus from product centric model to customer centric model.

- To know about customer’s loyalty towards BRAC Bank Ltd.

METHODOLOGY

The study will be conducted as a descriptive research, also known as statistical research. It describes data and characteristics about the population or phenomenon being studied. Descriptive research answers the questions who, what, where, when and how. The description will be used for frequencies, averages and other statistical calculations. This qualitative research is followed by answers of why the observations exist and what the implications of the findings are. Relationship depends on so many other things that determines whether a customer will be sustaining with this bank or switch to other. In a precise sense sometimes relationship depends on the satisfaction of the customers but satisfaction is not the only thing to define relationship.

COMPANY OVERVIEW

This chapter emphasizes on the historical background of the company under study, overview of the company, their product and services, customer base and market condition of BRAC Bank Ltd.

Historical Background of the Company

BRAC started as a development organization dedicated to alleviating poverty by empowering the poor to bring about change in their own lives. In Bangladesh It was founded in 1972 and over the course of evolution, it has established itself as a pioneer in recognizing and tackling the many different realities of poverty of which BRAC BANK is one of the largest operational commercial venture with a vision:

“Building a profitable and socially responsible financial institution focused on Markets and Business with growth potential, thereby assisting BRAC and stakeholders build a “just, enlightened, healthy, democratic and poverty free Bangladesh”.

BRAC Bank Limited is a scheduled commercial bank in Bangladesh. It established in Bangladesh under the Banking Companies Act, 1991 and incorporated as private limited company on 20 May 1999 under the Companies Act, 1994. BRAC Bank will be a unique organization in Bangladesh. The primary objective of the Bank is to provide all kinds of banking business. At the very beginning the Bank faced some legal obligation because the High Court of Bangladesh suspended activity of the Bank and it could fail to start its operations till 03 June 2001. Eventually, the judgment of the High Court was set aside and dismissed by the Appellate Division. BRAC Bank is one of country’s fastest growing banks, with 152 branches, 12 Apon Shomoy, 313+ ATMs, 30 CDMs, 399 SME Unit Offices and 7,695 (as on 15th July 2012) human resources, BRAC Bank’s operation now cuts across all segments and services in financial industry. With more than 1 Million Customers, the bank has already proved to be the largest SME financier in just 11 years of its operation in Bangladesh and continues to broaden its horizon into Retail, Corporate, SME, Probashi and other arenas of banking. In the year: 2010, BRAC Bank has been recognized as Asia’s most Sustainable Bank in Emerging Markets by the Financial Times and IFC.

Recently BRAC Bank has achieved the International award for “Excellence in Retail Financial Services”.

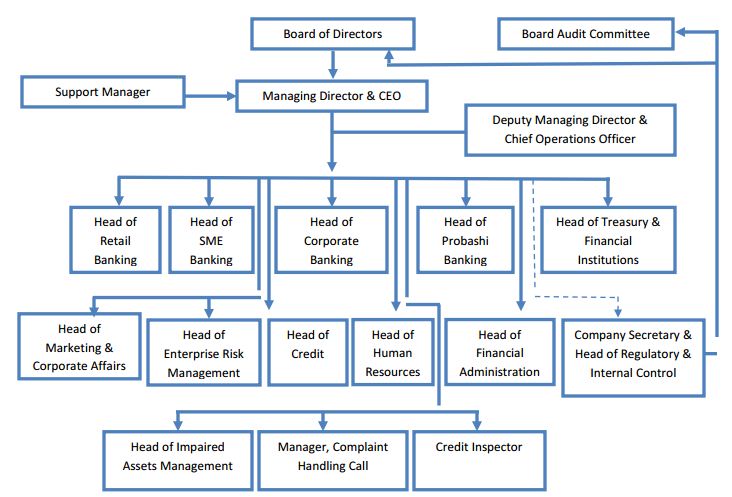

ORGANIZATIONAL STRUCTURE

SWOT ANALYSIS

A SWOT analysis is “a technique for matching organizational strengths and weaknesses with environmental opportunities and threats to determine the organization’s right niche”. SWOT analysis is an important tool for evaluating the company’s Strengths, Weaknesses, Opportunities and Threats. It helps the organization to identify how to evaluate its performance and scan the macro environment, which in turn would help organization to navigate in the turbulent ocean of competition. With this tool, we will be able to determine, though not perfectly, since we are not internal members of this organization, the internal strengths and weaknesses of BBL as well as the opportunities and challenges that the changing external environment provides.

Strength:

BRAC Bank has a strong financial back-up on the industry. Ample source of finance means it is in a better position to serve the market with its products & also it has the financial resources to grow its business.

• BRAC is the parent organization of BRAC Bank Limited that already has reputed brand name in its own industry. It ultimately helps BRAC Bank to get well familiar in the country within a short period of time.

• BRAC Bank is more emphasized on the SME sector of Bangladesh. Before BRAC Bank there was no private commercial bank which has focused on this sector.

• BRAC Bank Limited is providing diversified product and services to the market.

Weakness:

One of the major weaknesses that I have found during my internship period was their huge manpower. It is seen that BBL takes many initiatives but they cannot implement all their steps in a proper way because of its weak monitoring system.

• Higher interest than some other commercial private bank in Bangladesh is another weak point of BRAC Bank Ltd.

• Majority of its asset portion has come from its SME division. They have disbursed more than 50% of their total loans in SME sector so that’s why they have higher default rate.

• Remuneration package offered by BBL for its employee is lower than other private bank.

So many employees don’t get motivated while working on BBL. Ultimately it causes

higher employee turnover.

• Branch size of is another strong weak point of BBL. It has a huge number of customer base so most of the time its branches get jam packed at pick hour.

Opportunity:

BBL can offer more services to its debit and credit card.

• As BBL shifted its focusing field from product centric to customer centric it may allow them to explore some new group of customers.

• BBL can start taking some deposit to its SME customers as they have a huge customer from its SME service.

• Large market share in SME sector Bangladesh has given BBL immense opportunity build strong relationship with its customers. Most of the times customer does take repeat their loans that are taken under SME division.

• Average ages of BBL employees are less than 30. So BBL can bring more outputs from its young employees more than other private commercial banks.

Threat:

High competition with foreign banks is a tread for BBL. Majority people like to hold the credit card of SCB and HSBC in our country.

• Some new banks are coming in the market. These new banks can take customers from BBL. Customer will have more choices regarding selection of his\her desired banks.

• Majority of private commercial banks are now focusing on the SME sector. So they are hiring employee from BBL also. As a result SME division of BBL has a higher employee turnover rate.

• Political volatility is another thread for BBL.

• Sometimes Bangladesh Bank imposes some strict rules regulation to the private banks. These rules may become difficult for BBL to follow.

Overview of RRBBM

BRAC Bank Ltd recently has changed their business model from “Product Centric” to “Customer Centric” business model where there will be no traditional banking system and the latest customer wise different types of services will be provided. Actually they have segmented their customers in different categories and they will treat them by their segmentation. This type of segmentation from product centric to customer centric business model is first time

implemented in Bangladesh and BBL is the first initiator of this.

Product Centric Model

A product-centric collections strategy is generally focused on account-level collections, per product, based on product-owner defined rules. Collections actions are product-focused, hence relatively simple to articulate, manage, automate and measure. A collections call is generally made for each account. In other words, even if multiple accounts of the same type are delinquent, the customer will receive multiple calls, each specific to one delinquent account. The Advantages and Disadvantages of Product-Centric Model Product-centric model allow for driving efficiency and productivity. This includes:

- Standardization and automation of customer communications

- Call scripting

- Simple measurement

- Training of collectors on a single-product and system

- Simple incentivizing and performance measurement aligned with product metrics

However, a product-based collections approach has its disadvantages. In this approach the customer actions are based on customer information that is reflected in a single-product view. This may result in a fragmented customer experience and inconsistent or contradictory treatment and messages. The business could also overlook the seriousness of cross product defaulters, and take inappropriate lenient initial action.

Customer Centric Model

Customer-centric collections strategies usually aspire to deliver consistent treatment of customers across products, and ensure customer management decisions (pricing, risk-based decisions, service-level, sales strategy, collections strategy, etc) at customer portfolio level. Significance

A customer-centric firm hopes to achieve higher sales, profitability and new-product success because of their focus on customers. The firm also saves on costs for agent commissions and wins business over its competitors. According to studies quoted in the book “Designing the Customer Centric Organization,” existing loyal customers are the most profitable group of customers. Rather than spending its resources on capturing new customers, a firm should instead

use its resources on maintaining the loyalty of current customers.

Features

Becoming customer centric does not just involve customer service. A customer-centric firm detects the needs of its customers and uses its resources accordingly, while building relationships with them. All the business functions of the firm, including those that do not directly make contact with the customers, perform their roles with the customers in mind.

Identification

A customer-centric firm identifies the needs of its customers by dividing them into segments with common characteristics and determining the appropriate level of attention for them. A firm can classify its customers based on various factors, such as size, buying purpose, nature of products purchased, revenue, and potential for growth, geographic location and level of specialization required. A firm can collect the data using surveys and keeping data from all customer interactions, including sales, customer service, complaints, returns and third-party

vendors.

Implementation

A customer-centric firm arranges itself around the customers. Its strategy, structure, processes, reward systems and people have to aim to maximize customer satisfaction. For example, the firm focuses on creating products that the existing customers need, as opposed to finding customers for its products. The firm rewards the managers who build customer relationships, rather than those who manage deadlines. The employees focus on customer retention, as opposed to reaching a certain share of the market.

Considerations

A firm must not over-customize its products to match customer requests to the point where profit suffers. For example, Japanese software companies often create many different versions of software products for different customers. As a result, they fail to reach economies of scale and do not have enough resources for international expansion. A firm should also not focus too much on its best customers when considering a new technology.

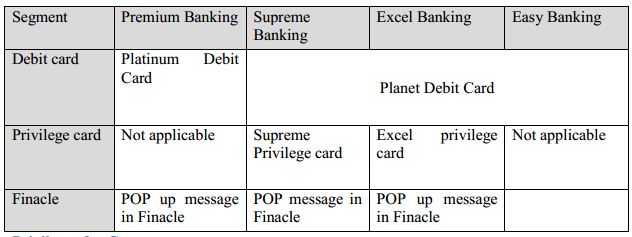

Customer Segmentation:

BBL have grouped their customers into four segments namely,

- Premium Banking

- Supreme Banking

- Excel Banking

- Easy Banking

QUANTITATIVE DATA ANALYSIS

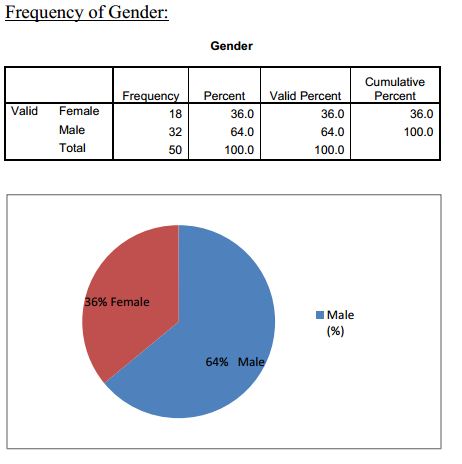

I have found 50 samples from two branches of BBL. Out of these 50 customers 18 are female and 32 are male. It means 36% are female and 64% are male on my survey.

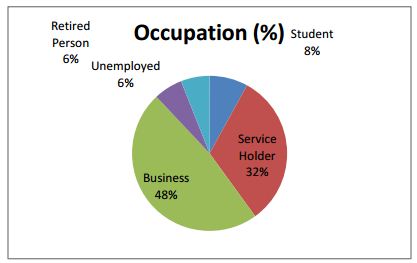

Frequency of Occupation:

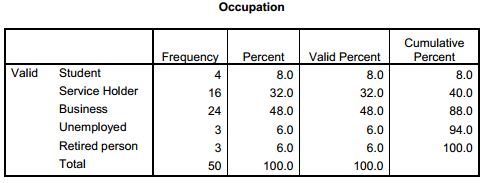

About 48% customer’s occupation of BBL is business and 32% customers are service holder. Whereas 8 customers are student and 6% are retired person and 6% are unemployed.

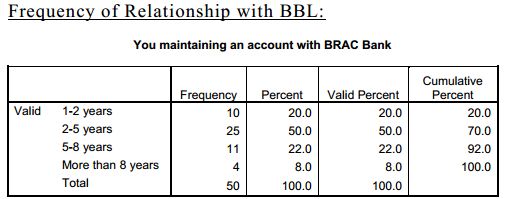

BBL is the youngest private commercial bank in Bangladesh. That’s why the customer relations are also not so long. As we know its emerging rapidly day by day, we can see the trend of account maintaining of customers. Those who are with us for 2-5 years, they are much matured and potential customers of BBL as there is chance to make them loyal for BBL.

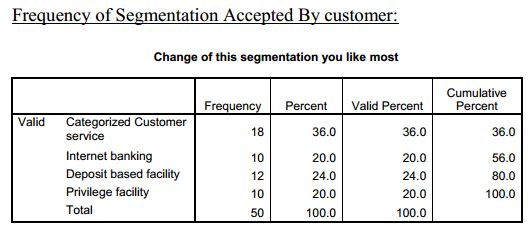

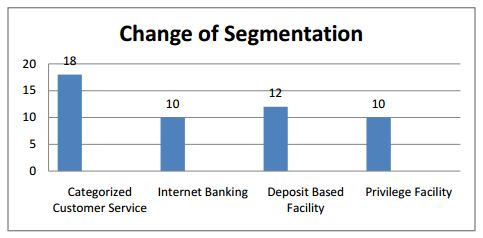

After being categorized customers started to like the segmentation of BBL. 20% customers have shown their interest to the privilege facility of BBL. Before this segmentation customers were not getting treated based on their transaction or deposit but now they are getting some priority based on their deposit as well.

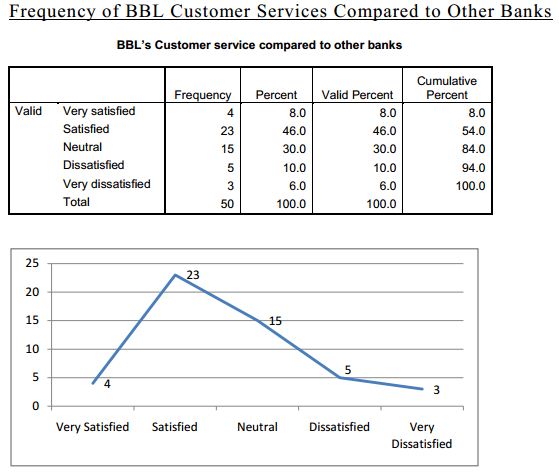

46% of BBL customers are satisfied with their customer service. 30% customers are neutral regarding BBL customers service. So it could have been better if BBL could make few of these customers satisfied.

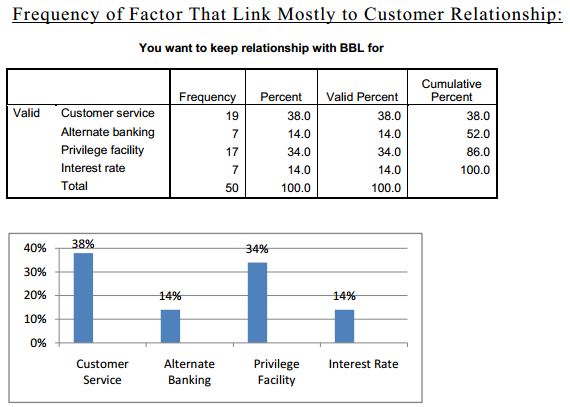

From my survey I have found that 38% customers want to keep relationship with BBL for its customer’s service and 34% customers are interested for their privilege facility. Rests of others are concern about alternate banking and interest rate. After focusing to customer centric model customers are getting more privilege so it ultimately encourages customers to have a long term relationship with BBL. Even after imposing RRBBM customers are getting better service in their own branches. So those are supreme and excel customers they are being motivated to continue their relationship with BBL.

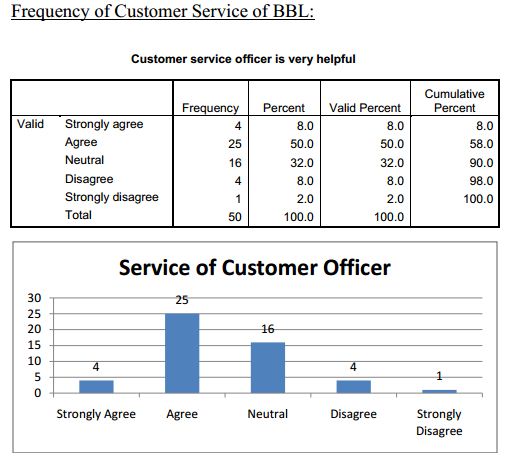

Total 58% customers have agreed that customer service officers of BBL are very helpful. 32% customers are neutral and 10% of customers are disagreed with this statement. From this table we can state that most of the customers are satisfied about the service of customer officers. After deploying supreme counter in few of the branches of BBL customers are getting better services from the customer service officer of BBL. Supreme customers don’t have to take the load of waiting in the line to get their service as they have their own dedicated counter.

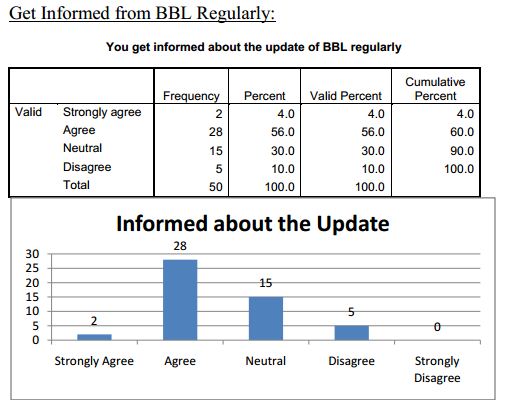

62% of BBL customers are agreed that they get informed of any update of BBL regularly and10% are disagreed that they don’t get informed from BBL. 30% customers are neutral about this statement it means they are not aware about getting informed. BBL has a huge customer base. In order to make this people informed about any update, BBL needs to have some dedicated department like outbound call center.

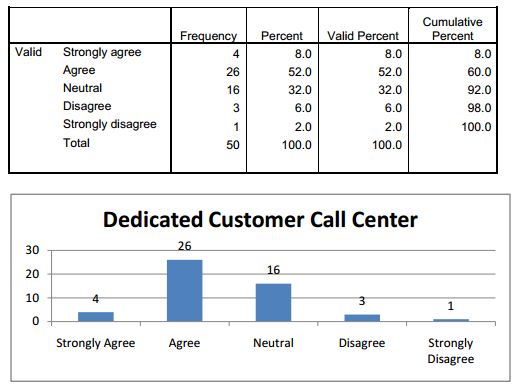

Regarding Dedicated Customer care:

Altogether 60% customers are agreed that BBL has a dedicated customer call center for them. Most of the neutral customers cannot reach to customer call center easily that’s why they marked at neutral. Only 8% customers do think that BBL doesn’t have a dedicated customer call center.

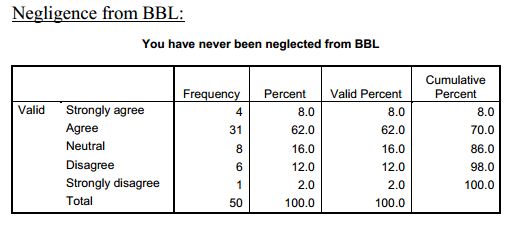

From the above data we can derive that 62% agreed and 8% strongly agreed it means total 70% customer are agreed that they have never been neglected from BBL. Only 14% customers didn’t agree with this statement.

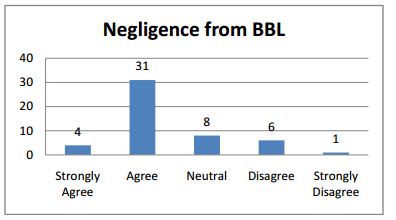

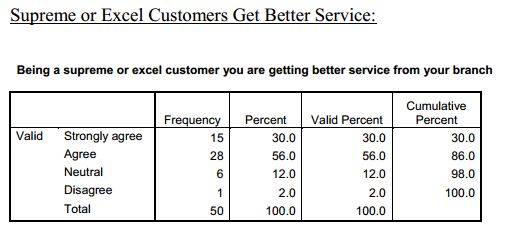

It clearly shows that those who are supreme and excel customers they get better service from their branches. Altogether 86% supreme customers are getting better service from their branches which must be considered as an achievement of BBL. Still 12% customers wanted to be neutral and 2% customers are disagreed that they don’t get better service from their branches.

CROSS TABULATION:

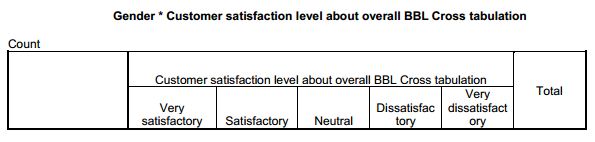

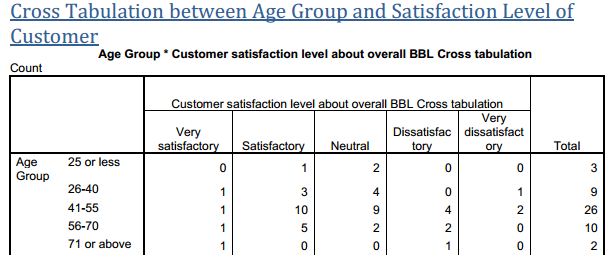

It is mentioned earlier that the Dependent variable is Customer relationship. The variable is correlated with independent variables like gender, age, occupation, and income level of the customers to measure the level of customer relationship in the view of these aspects individually. Figures and tables are derived with the help of SPSS by the process of Cross Tabulation. Cross Tabulation Between gender and Satisfaction Level of Customer

The purpose of doing this Cross Tabulation between the levels of customer relationship and gender is to project that which gender is more satisfied in the organization. As shown in table total 14 out of 32 male respondents are satisfied, whereas total 9 out of 18 female customers are satisfied with the entire environment of BBL. 12 male and 5 female customers is neutral, where only 3 male customers are very dissatisfied and 4 female customers are only dissatisfied.

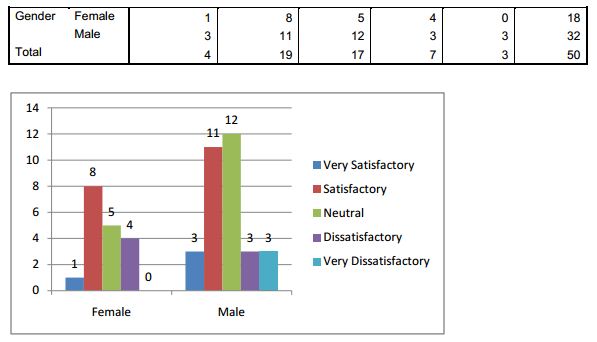

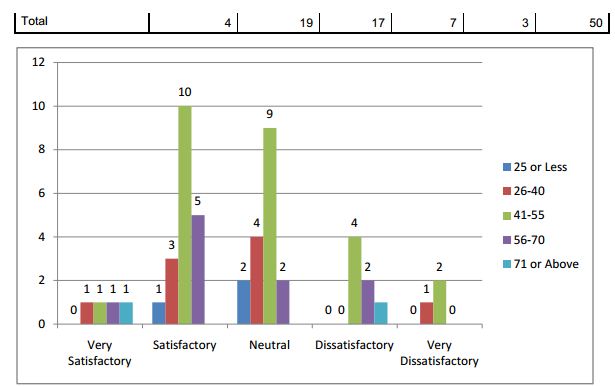

It is seen that out of 26 from 50 customers whose age is in between 41-55 are mostly satisfied with the relationship with BBL. Reason behind this satisfaction is the service and 10 customers whose age is in between 56-70 are also satisfied with BBL.

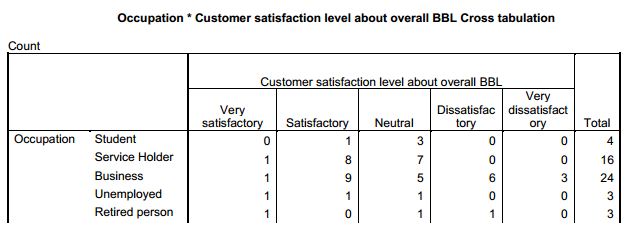

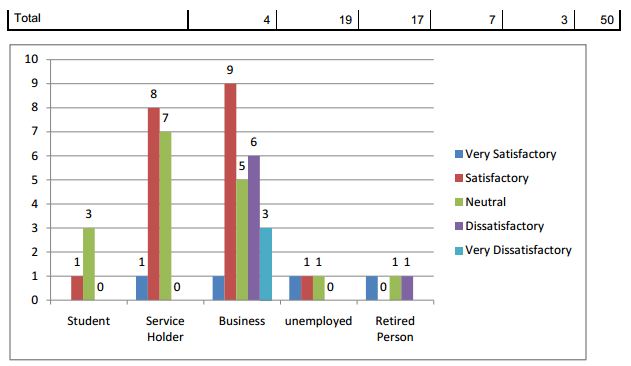

Cross Tabulation between Occupation and Satisfaction Level of Customer

As shown in the Table most businessman (total 10 out of 24 respondents) and service holders (total 9 out of 16 respondents) are satisfied with BBL. Therefore, it can be stated that Businessmen are mostly satisfied in BBL customer relations. However; businessmen are also in bigger number with dissatisfaction.

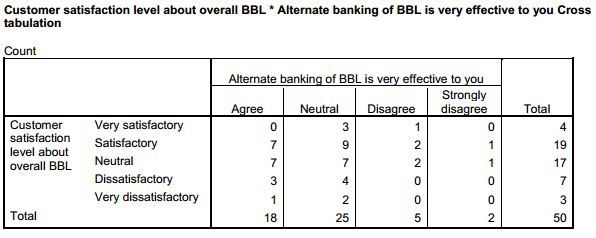

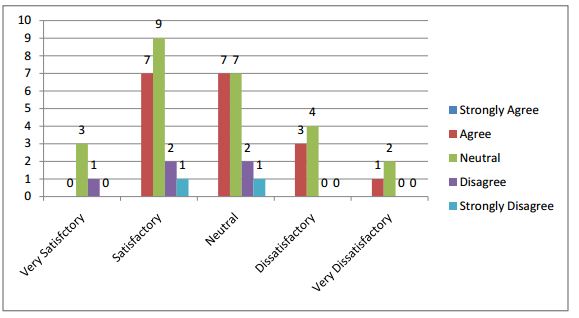

Cross Tabulation between Customer Satisfaction Level and those who use alternate banking facility

There is no customer who strongly agreed that he\she uses alternate banking. But out of 18 customers who agreed that they use alternate banking like internet banking, customer call center etc are satisfied with the overall performance of BBL. However, total 23 customers are satisfied about overall bbl but out of these 23 customers 9 customers are neutral about alternate banking, it means they may have no idea about the alternate banking of BBL.

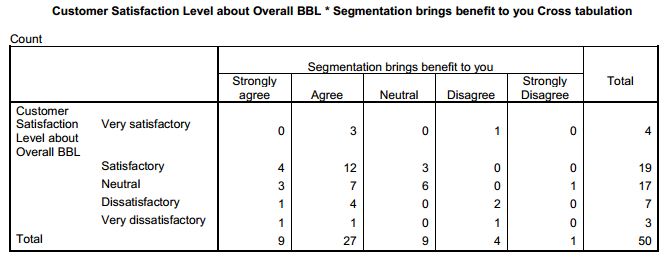

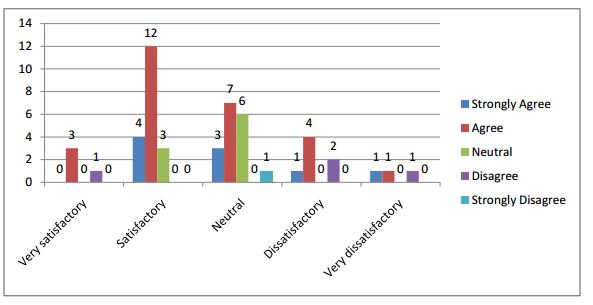

Cross Tabulation between Customer Satisfaction Level and Segmentation Brings Any Benefit

Total 36 customers have agreed that segmentation brings benefit to them and out these 36 customers total 16 customers are satisfied about overall performance of BBL. 17 customers are neutral about the satisfaction level about BBL but still out of these 17 customers altogether 10 customers think that segmentation may bring some benefit from them.

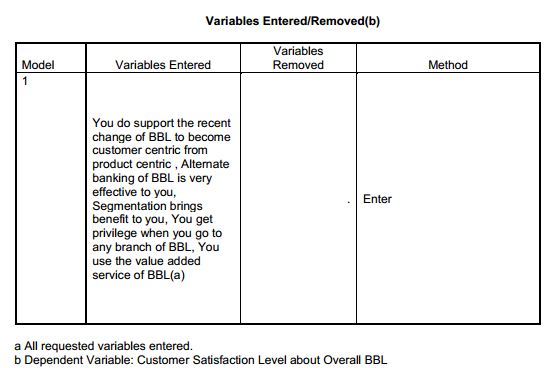

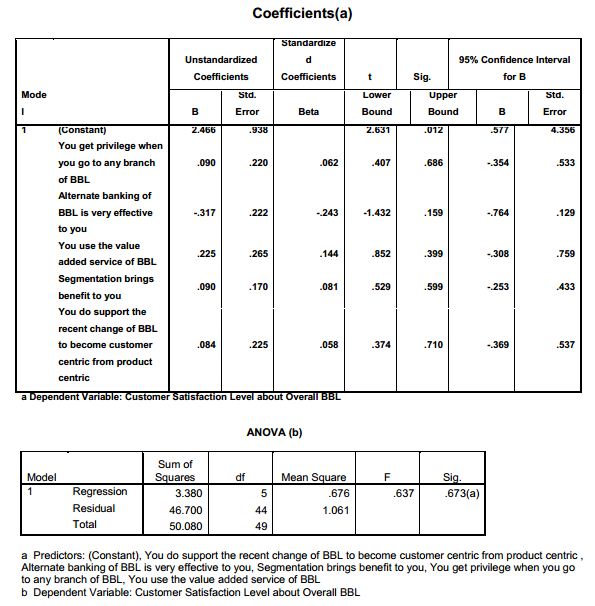

REGRESSION and ANOVA:

Regression analysis is a statistical tool for the investigation of relationships between variables. Usually, it seeks to ascertain the causal effect of one variable upon another. It also typically assesses the “statistical significance” of the estimated relationships, that is, the degree of confidence that the true relationship is close to the estimated relationship. From the regression analysis, the value of the R-square has been observed. Linear regression was conducted to get the F test (ANOVA) mainly. From the ANOVA relationship with dependent and independent

variables were shown. There are two basic hypotheses about this ANOVA thing, these are given below:

Null Hypothesis: Ho = Customer satisfaction on Restructuring Retail Banking Business Model (RRBBM) of BRAC Bank Ltd is not satisfactory.

Alternative Hypothesis: H1 = Customer satisfaction on Restructuring Retail Banking Business Model (RRBBM) of BRAC Bank Ltd is satisfactory.

There are many independent variable factors that determine the dependent variable ‘customer satisfaction’ about the bank but I have chosen the most important 5 variables which are related to the new project of BBL, Restructuring Retail Banking Business Model (RRBBM).

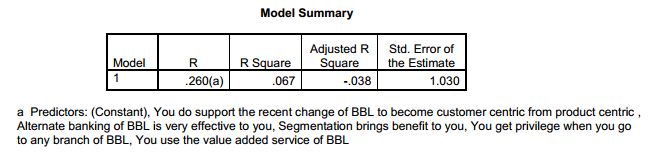

The value of R-square is 0.067, which is greater than 0 and this indicates that the strength of the impact of the variable on the overall satisfaction level mentioned by customer is strong. In the ANOVA section, the P value is 0.673 which is greater than .05 so we are fail to reject the null hypothesis Ho. Therefore, we accept the Null Hypothesis and can conclude that Customer Satisfaction on Restructuring Retail Banking Business Model (RRBBM) of BRAC Bank Ltd is not satisfactory.

FINDINGS:

BRAC Bank Ltd is an organization which is operating their business successfully in the banking sector since 2001. Therefore, it is very tough to recommend on any aspect of the company. However, as it is the requirement of the report so I have come up with few recommendations, after conducting the research. They are as follows:

• BBL should try to improve the effectiveness of their alternate banking. From my survey I have found that 50% customers are neutral about the effectiveness of the alternate banking. So BBL should emphasize to decrease the numbers of neutral customers about alternate banking.

• 64% customers have agreed that BBL should come with more new product and services. BBL should extend their product for working woman and student.

• From my visit to BBL branches I have found that most of the branch of BBL is too small. Size of their branch is another reason to get hazarded so they should try to increase size of the floor of their branch.

• Upper level management of BBL should emphasize on the monitoring of implementation of all the initiatives taken by BRAC Bank Ltd.

• BBL should monitor whether their tied up merchant shops are giving any discount\benefit to their customers or not.

• BBL needs to make sure that customers are well familiar with their all new initiatives.

• BBL should review their customer centric product model to find out more improvement for their customers.

• From my survey I have found that BBL has a small number of customers whose ages are less than 25. So BBL should look to the young generation too.

• Most of the customers of BBL have an income of in between 21000 to 80000. Around 72% customers are in this group. So I guess BBL should emphasize more on those customers who have a salary of more than 1 lakh.

CONCLUSION

In this age of modern civilization bank is playing its splendid role to keep the economic development wheel moving. We can see lot of new commercial banks has been established in last few years and these banks have made banking sector more competitive. Maintaining a strong relationship has become a weapon for most of the private banks in this competitive market. Customers are the main blessings for any business. Banking sector is service based business. So customer would prefer to take the service from those banks which are providing the highest level service to their customers and BRAC Bank is definitely one of them. On this regard BRAC Bank has taken some initiative by taking a new project of Restructuring Retail Banking Business Model (RRBBM) to improve the customer relationship. They are the first one in banking sector of Bangladesh introducing customer centric business model instead product centric model. So, if they can implement and continue it properly, hopefully they will be one of the top successful banks in Bangladesh.

It was an honor for me that I have worked as an intern in a reputed organization like BRAC Bank Limited. BBL is a bank that confirms the best service to its customers by adopting the modern tools of banking. BRAC Bank Ltd is always very keen to absorb any new stuff that can be fruitful to its customers. By working in the Supreme and Excel banking division, the knowledge I learnt would be helpful enough to sustain in the real organizational environment.